MODEL 720 TAX DECLARATION

All those tax residents in Spain, should be aware that as a result of legislation passed on 29th October 2012 for the prevention and control fraud, all natural or legal persons resident in Spain who have any assets outside of Spain with a value of 50.000 Euros or more, are required to submit this declaration formto the Spanish Tax Authorities.

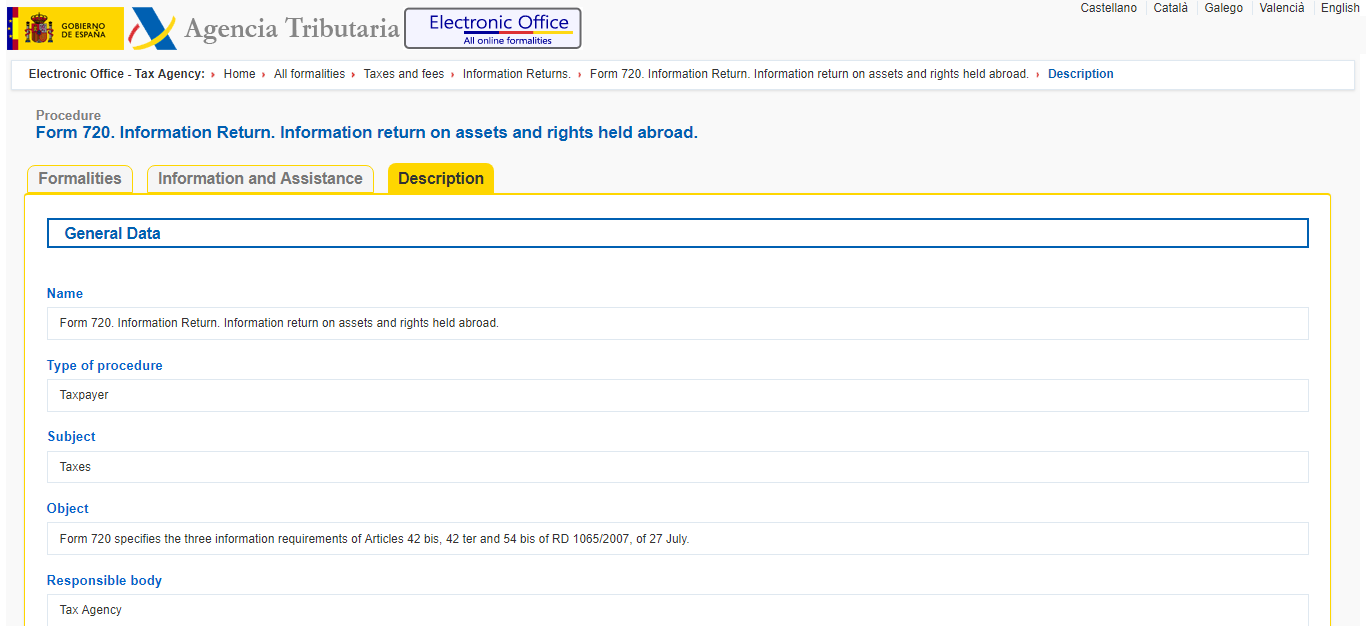

The declaration can be made on line, through the Tax Office´s web page www.agenciatributaria.es where the Model 720 ( Statement of Assets Outside Spain ) can be located and completed. It must be filed between January 1 and March 31, of the first year of residence, to avoid being investigated or fined by the Spanish authorities.

The assets outside of Spain that are subject to this new declaration form fall into 3 categories:

A) Real Estate

B) All types of accounts, investments, bank deposits and companies

C) Actions, shares, insurance, rent, bonds or dividends acquired or managed outside Spain

To warrant a declaration the total value of assets should be 50.000 Euros or more in EACH OR ANY ONE of the categories.

E,g.- If we have three properties valued at 40.000 Euros although the value individually would be below the threshold the total value of both would be 80.000 Euros thus exceeding this limit, and therefore subject to this new declaration, completion and filing of Model 720.

However if you have a property valued at 40.000 Euros and say, shares valued at 40.000 as they are in separate categories and each total value does not exceed the 50.000 Euros then you would not be required to make a declaration.

A declaration must be submitted individually by the owner/s, regardless of their number and the percentage of participation, which would be established later. For example, if you own half of a property with a value of 50.000 Euros, although your particular 25.000 Euros share is below the threshold, each owner would still be required to submit an individual declaration based on the total value of the property.

The declaration can be made on line, through the Tax Office´s web page www.agenciatributaria.es where the Model 720 ( Statement of Assets Outside Spain ) can be located and completed. It must be filed between January 1 and March 31, of the first year of residence, to avoid being investigated or fined by the Spanish authorities.

The assets outside of Spain that are subject to this new declaration form fall into 3 categories:

A) Real Estate

B) All types of accounts, investments, bank deposits and companies

C) Actions, shares, insurance, rent, bonds or dividends acquired or managed outside Spain

To warrant a declaration the total value of assets should be 50.000 Euros or more in EACH OR ANY ONE of the categories.

E,g.- If we have three properties valued at 40.000 Euros although the value individually would be below the threshold the total value of both would be 80.000 Euros thus exceeding this limit, and therefore subject to this new declaration, completion and filing of Model 720.

However if you have a property valued at 40.000 Euros and say, shares valued at 40.000 as they are in separate categories and each total value does not exceed the 50.000 Euros then you would not be required to make a declaration.

A declaration must be submitted individually by the owner/s, regardless of their number and the percentage of participation, which would be established later. For example, if you own half of a property with a value of 50.000 Euros, although your particular 25.000 Euros share is below the threshold, each owner would still be required to submit an individual declaration based on the total value of the property.